Trading on the forex market is an investment strategy that is growing in popularity. If you have been tempted to enter the market, make sure you educate yourself on the basics first. Many novice traders end up falling into common traps. So, use the ideas in this article to help avoid them.

Make a plan and stick to it. Forex trading has many ups and downs that can send your emotions on a tailspin. Creating a plan and sticking to it religiously is crucial to avoid making decisions based on greed or fear. Following a plan may be painful at times but in the long run it will make you stronger.

If you are losing money, cut your losses and run. Traders often make the mistake of trying to ride out the market until a turn around, however this is often a mistake. If you are showing a profit, keep going but when things turn south get out. Make this tip a integral part of your trading plan.

When trading Forex, it is important that you not fight the trends, or go against the market. It is important for your own peace of mind, as well as your financial well being. If you go with the trends, your profit margin might not be as immediately high as jumping on a rare trade, however the chance you take with the alternative, and the added stress, are not worth the risk.

Log and journal everything you do when you are trading. By carefully tracking your successes and failures, you give yourself a reference point by which to make future decisions. If you do not have a personal log of your experiences, you will be taking positions blindly and experience more losses.

When going into forex trading, it’s important that you have a firm hold on your emotions, especially your greed. Don’t let the promise of a large reward cause you to over-extend your funds. Trade on your rational plan, not on your emotions or your “gut” if you want to be successful.

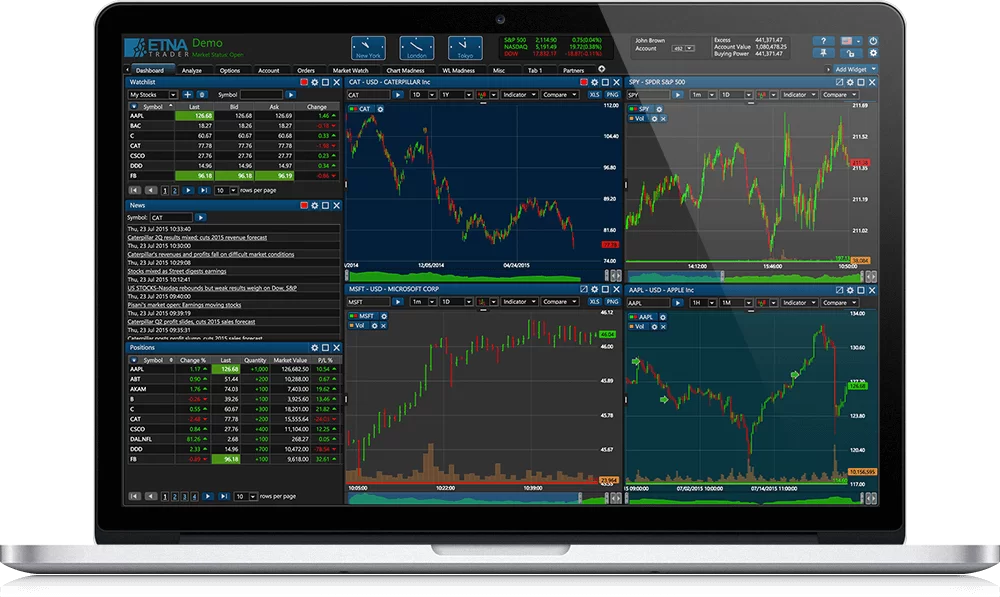

As a beginning forex trader, a fast computer and Internet connection are essential. You’re going to need to check the markets as often as possible, and things can change drastically in a heartbeat. Day traders need to stay as alert as possible to stay aware of rapid changes in the exchange.

Choose an experienced broker to help you start out. Ask around, and plan to do research before you choose someone to help you. An inexperienced, or worse, unethical, broker will tear down all the gains you may have already made. Choose someone who knows how to work with your level of expertise.

In trading, you need to know when to cut your losses. You need to pull out with losses early to avoid them growing worse by leaving them in longer. This is real money you have on the line, so be smart about when you should place a stop on your loss to minimize its effect.

By now you should have acquired a good understanding of the basic concepts of successful forex trading. If you keep these ideas in mind and let them guide your trading, you will see great results. Just remember what you’ve learned, and you will get the best return on your investment.